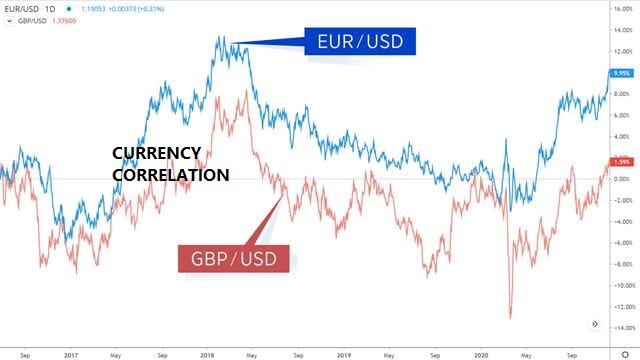

Diversification involves spreading investments across different assets, currencies, or regions to reduce risk and enhance returns. In forex trading, diversification can be achieved by trading multiple currency pairs with low or negative correlations. By diversifying across currency pairs, traders can mitigate the impact of adverse movements in one currency pair on the overall portfolio. Diversification also helps traders capture opportunities in various market conditions and minimize the concentration risk associated with single-currency exposure.

Moreover, diversification extends beyond forex trading and encompasses the integration of other asset classes into the investment portfolio. Combining forex trading with stocks, bonds, commodities, or real estate allows traders to create a diversified investment portfolio that offers exposure to different market segments and economic sectors. This multi-asset approach helps reduce portfolio volatility and enhances the stability of investment returns over time.

Effective diversification strategies require careful asset allocation, risk assessment, and periodic portfolio rebalancing. Traders should analyze currency correlations regularly and adjust portfolio allocations based on changing market conditions and risk preferences. Additionally, traders should consider factors such as volatility, liquidity, and macroeconomic trends when diversifying their portfolios across currency pairs and asset classes.

In conclusion, currency correlation and diversification are essential components of risk management in forex trading. By understanding the relationships between currency pairs and diversifying across assets with low correlation, traders can effectively manage risk, enhance returns, and create a resilient investment portfolio. Incorporating currency correlation and diversification principles into trading strategies empowers traders to navigate the dynamic forex market with confidence and achieve long-term success.